Rethinking My Hotel Points Strategy

-

AFFILIATE DISCLOSURE:

Packed with Points is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com and bankrate.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

EDITORIAL DISCLOSURE:

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

*Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

If you haven’t already heard…Chase has made quite a few eligibility changes over the past year that make it quite a bit harder to open their credit cards to earn the welcome offers. 😢 Which means it’s a sad time for us points & miles enthusiasts and Hyatt loyalists!

A question I’ve been getting often is how I’m handling these changes and what my new strategy will be. So let’s talk hotel points strategies and how I’m shifting gears in my travel planning.

A brief overview of the changes

The biggest changes we’ve seen from Chase over the past year impacted their Ink business cards and the Sapphire family of cards.

➡️While you used to be able to earn the welcome offer on the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® once every 48 months, these welcome bonuses are now once per lifetime.

➡️The family of Ink business credit cards had very unclear rules in the past, and it seemed like there were few restrictions on who could earn the welcome bonus. I know many people who held multiple of each card, and had earned the welcome bonus many times from these cards. With the new changes to the eligibility, these welcome bonuses are now also once per lifetime.

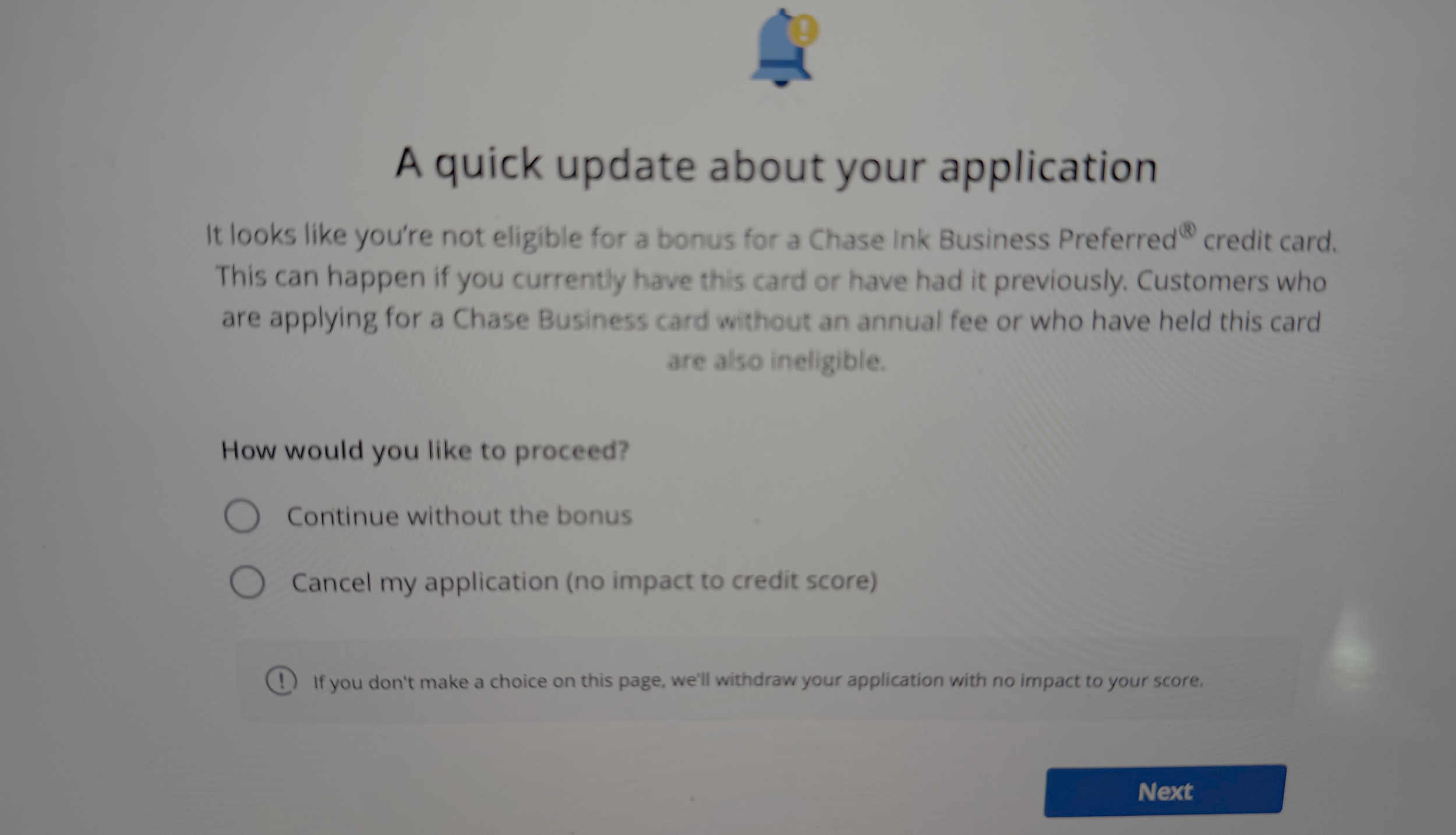

‼️Many people (myself included) have gotten this pop up message when applying for one of their business cards:

*So now that there are tightened restrictions on these cards, I definitely recommend waiting to apply for these cards until they have an elevated offer!

How I use my Chase Ultimate Rewards®

First of all, when it comes to my Chase points, I almost always use them for Hyatt stays.

“Why?” you ask….

Chase is the only major bank that transfers points to the World of Hyatt, meaning this is my primary way to earn points for Hyatt stays. And Hyatt is not created equal when it comes to other hotel transfer partners. Hyatt has (hands down🙌🏼) the BEST value and award rates, so it’s my go to! Not to mention some of their incredible bucket list properties, amazing all-inclusive resorts, and convenient family-friendly hotels.

✈️I could also use my Chase points for flights, but I prefer to use other flexible point currencies (like Amex Membership Rewards® or Capital One Venture Miles) for my flights so I can save these points for Hyatt bookings.

So my current strategy? 🤔 I’m focusing on saving up the Chase points that I have for bucket list stays and Hyatt resorts that I’ve been really wanting to stay at (Andaz Costa Rica, glamping with Under Canvas, Secrets Baby Beach, Hyatt Regency Maui, etc.).

What cards I’m opening lately

In the past, we were able to open multiple Ink business cards to keep earning large amounts of Chase points, but since their new rules essentially restrict you to one welcome bonus per lifetime, I’ve had to pivot.

⭐️First of all, like I mentioned, I am more intentional about how I am using the current Ultimate Rewards that I do have and saving them for popular Hyatt properties that I’ve been really wanting to stay at. And for our next all-inclusive vacation!

Secondly, I have my eye on the cobranded World of Hyatt credit cards that will be part of my new card strategy for 2026. The personal card is a great long term keeper card since you will earn a category 1-4 free night award annually! 👏🏻

Diversify!

Overall, this has encouraged me to diversify my hotel points even more than I was before. I am taking advantage of elevated cobranded hotel card offers more often for brands like Marriott, Hilton, and IHG will be next.

🏨Hilton has always been a top contender for award stays because they have a great line up of cobranded cards through American Express®, a huge portfolio, no fees on award stays, and the most generous free night awards! The best time to open one of their cards is when they have the elevated offers that come with a Free Night Certificate.

🏨 Marriott also has business and personal card options, so they have multiple opportunities to start earning a stash of Marriott points for your next vacation. I personally prefer the 5 free nights offer that comes around at least once a year on the Marriott Bonvoy Boundless® Credit Card!

💳Find our top credit card recommendations to earn points for hotel stays HERE! Thank you SO much for using my links to apply and support PWP 🩷

Bottom line

We all have to be a bit more creative with our points and miles strategies in the next year as we adapt to all the changes we have seen from the banks. I plan on being more selective about the Hyatt properties I book, and focus more on Hilton and Marriott points for a more diverse hotel plan.

🌎If there is one guarantee in the points and miles world, it’s that change is CONSTANT. So being able to adapt is crucial! But have no fear, I’m here to help you along in your journey. 😉👌🏼 Let me know your thoughts on your plans for hotel points!

EDITORIAL DISCLOSURE: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.